Tap. Shop. Spend.

The international debit card for daily spending

Easy to set up, quick to get, and ready to use with no hidden fees. Get your free virtual TransferGo Visa debit card today and upgrade to a physical card anytime.

Scan to download the TransferGo app

Secure, convenient payments ON THE GO

Shop online, in-store, or on the move—and receive payments securely. TransferGo’s debit card gives you global flexibility wherever you are.

Moving to the UK? It’s quick and easy to get started:

Seamless spending and withdrawals

Perfect for receiving salaries, managing payments, local shopping, and online spending.

Global acceptance

Enjoy the freedom to spend anywhere Visa is accepted.

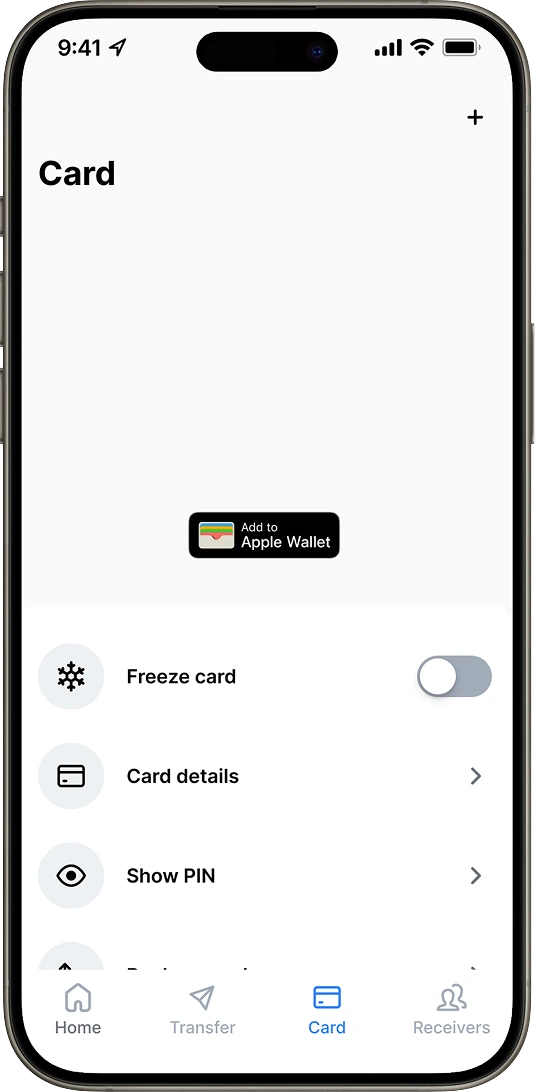

One powerful, easy-to-use mobile app

Manage your card, top up, send money with competitive rates, plus much more.

Scan to download the TransferGo app

Pick the card

that suits your needs

Getting started

Download the TransferGo app and get your free card in minutes

1

Verify

Confirm your ID and choose your plan

2

Order

Get a virtual card instantly or a physical one delivered fast

3

Enjoy

Top up your account and start spending

Scan to download the TransferGo app

Virtual

debit card

Instant, free, secure, and ready to use—our virtual Visa debit card lets you shop online and spend globally with ease. Perfect for digital shoppers and those who want fast access without waiting.

Physical

debit card

Perfect for those new to the UK—our physical Visa debit card is easy to get and lets you spend securely anywhere Visa is accepted, including ATM withdrawals. The best part? It’s free until 2026.

Pick the card

that suits your needs

ESSENTIAL

FREE

Everything you need for secure, everyday spending—fast money transfers, a digital debit card for international use, and a multi-currency account.

GBP virtual VISA debit card

Send, receive, hold and exchange GBP, EUR or PLN

Top up balances via bank transfer or card

Spend worldwide with no hidden costs

EXTRA

£4.99/Monthly

Free until early 2026!

Everything in the Essential Plan, plus:

New to the UK? Get a physical card that’s easy to set up, with free ATM withdrawals, priority customer support, faster transfers, and lower fees.

GBP physical Visa debit card

ATM withdrawals (UK & EEA): £500 free/month (up to 3 withdrawals), then 1.5% (min £1)

ATM withdrawals (Rest of World): £200 free/month (up to 3 withdrawals), then 3% (min £1)

Priority Customer Support

Overview

Card type

Currencies

Top-up options

Coverage

ATM withdrawals

ESSENTIAL

FREE

Keep it simple with fast money transfers, a secure digital debit card, and smart online spending with no hidden fees.

Virtual GBP Visa debit card

Send, receive, hold, and exchange GBP, EUR or PLN

Bank transfer

Worldwide, no hidden costs

Not included

EXTRA

£4.99/Monthly

Free until early 2026!

Everything in Essential, plus faster transfers, lower fees, priority support, physical and virtual card, and free global ATM withdrawals.

Physical + virtual GBP Visa debit card

✅

✅

✅

– UK & EEA: £500 free (up to 3 withdrawals per month), then 1.5% fee (min £1)

– Rest of World: £200 free (up to 3 withdrawals per month), then 3% fee (min £1)

COMING SOON

Smarter plans and exciting features are coming your way very soon! Sign up for updates you won’t want to miss.

Multi-currency account.

Introducing our multi-currency account

There’s far more to TransferGo than fast, affordable international payments. With our new account, you can send, receive, hold and exchange multiple currencies. Plus, get more value with exclusive in-app FX rates and instant, zero-fee transfers between accounts. And the best part? It’s free!

Frequently asked questions

What is TransferGo’s debit card?

A virtual and physical Visa debit card designed for people living internationally. Spend securely anywhere in the world, whether in-store or online, withdraw cash, and manage it all through the TransferGo app.

Who is eligible to apply for a TransferGo card?

Anyone with a verified TransferGo account who is 18 or older. T&C’s apply. Get your debit card online.

Can I use the card outside of Europe?

Yes! Your card works internationally—anywhere Visa is accepted, across Europe and beyond.

What currencies can I hold with the card?

The card is linked to your GBP account, but you can send, receive, hold, and exchange GBP, EUR, and PLN with your multi-currency account—with more currencies coming soon.

How do I top up my card?

Top up your card via bank transfer.

What makes TransferGo’s card the best debit card for international use?

TransferGo’s debit card stands out as one of the best international debit cards because it works anywhere in the world Visa is accepted.

Can I use TransferGo as a business debit card?

Currently, TransferGo debit cards are tailored for individuals. For business debit card solutions, please check our upcoming features or contact support for details.

The card is issued by B4B Payments pursuant to license with Visa.