Tap.

Swipe.

Go.

The physical debit card

Your physical TransferGo Visa debit card gives you secure, contactless spending anywhere Visa is accepted—online or in person. Delivered fast and free for a limited time.

Scan to download the TransferGo app

Everyday payments made simple

Fast to get, easy to use

Shop online, in-store, and withdraw cash—with one card linked to your TransferGo GBP Account and managed easily in the app.

Spend anywhere

Withdraw Cash

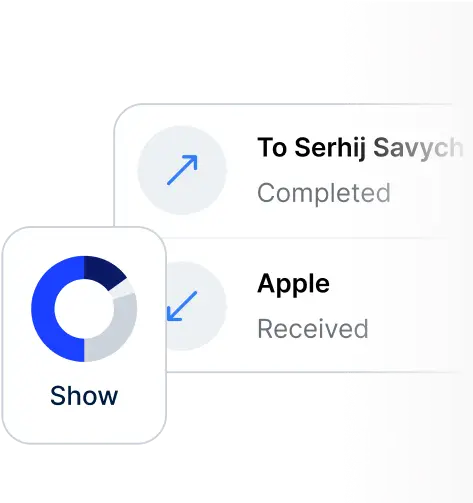

Manage your card in our easy-to-use mobile app

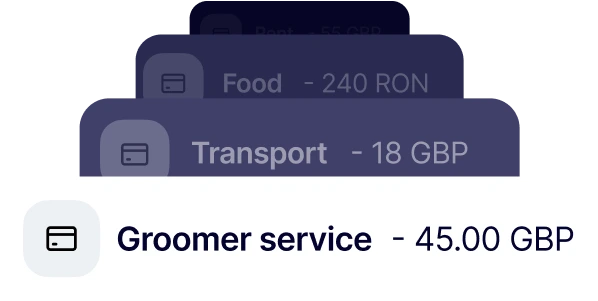

Smart spend insights

Scan to download the TransferGo app

Why choose a physical card?

The physical TransferGo Visa debit card lets you shop in-store or online with ease and security. It’s convenient, reliable, and works even when your phone doesn’t.

Delivered fast and free—no detailed proof of address needed

Perfect for everyday spending, online and offline

Linked to your GBP account

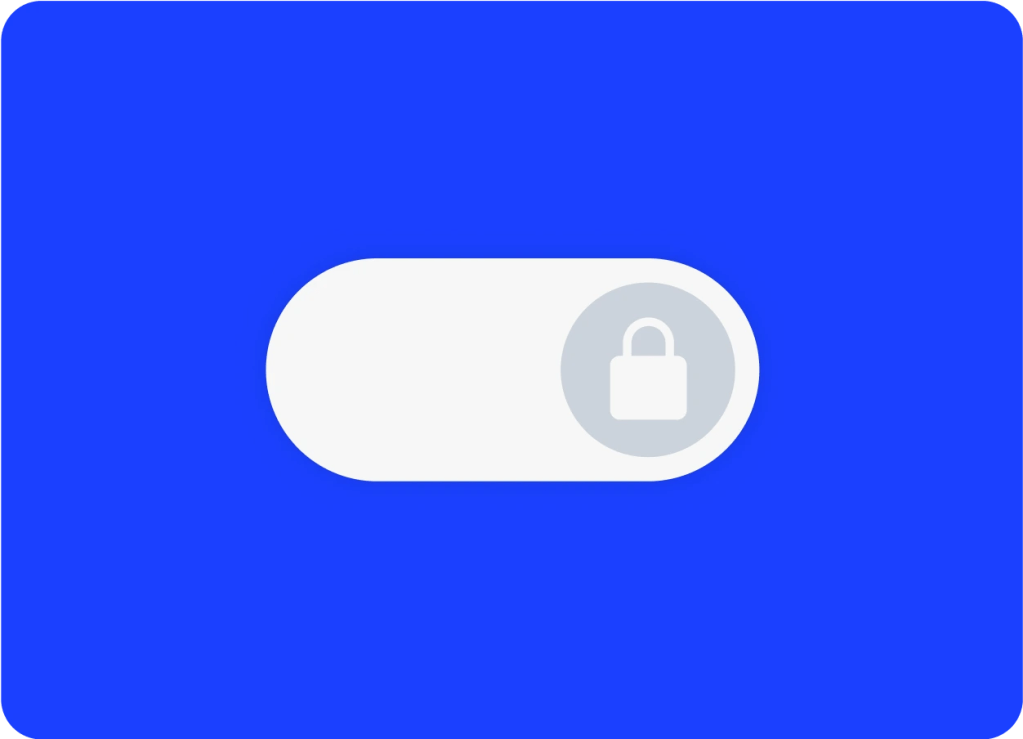

Instantly FREEZE/UNFREEZE your card

Fully encrypted and protected for your SAFETY

Scan to download the TransferGo app

Unlock secure, smart spending

Download the TransferGo app and get your free card in minutes

1

Verify

Confirm your ID

2

Order

Get a virtual card instantly

3

Enjoy

Top up your account and start spending

Scan to download the TransferGo app

Pick the card

that suits your needs

ESSENTIAL

FREE

Everything you need for secure, everyday spending—fast money transfers, a digital debit card for international use, and a multi-currency account.

GBP virtual VISA debit card

Send, receive, hold and exchange GBP, EUR or PLN

Top up balances via bank transfer or card

Spend worldwide with no hidden costs

EXTRA

£4.99/Monthly

Free until early 2026!

Everything in the Essential Plan, plus:

New to the UK? Get a physical card that’s easy to set up, with free ATM withdrawals, priority customer support, faster transfers, and lower fees.

GBP physical Visa debit card

ATM withdrawals (UK & EEA): £500 free/month (up to 3 withdrawals), then 1.5% (min £1)

ATM withdrawals (Rest of World): £200 free/month (up to 3 withdrawals), then 3% (min £1)

Priority Customer Support

Overview

Card type

Currencies

Top-up options

Coverage

ATM withdrawals

ESSENTIAL

FREE

Keep it simple with fast money transfers, a secure digital debit card, and smart online spending with no hidden fees.

Virtual GBP Visa debit card

Send, receive, hold, and exchange GBP, EUR or PLN

Bank transfer

Worldwide, no hidden costs

Not included

EXTRA

£4.99/Monthly

Free until early 2026!

Everything in Essential, plus faster transfers, lower fees, priority support, physical and virtual card, and free global ATM withdrawals.

Physical + virtual GBP Visa debit card

✅

✅

✅

– UK & EEA: £500 free (up to 3 withdrawals per month), then 1.5% fee (min £1)

– Rest of World: £200 free (up to 3 withdrawals per month), then 3% fee (min £1)

COMING SOON

Smarter plans and exciting features are coming your way very soon! Sign up for updates you won’t want to miss.

Frequently asked questions

What is a physical TransferGo Visa debit card?

A physical debit card is a tangible card linked to your TransferGo GBP Account that you can use for in-store, online purchases, and ATM withdrawals.

What is the difference between virtual and physical debit cards?

A virtual card exists digitally on your phone for online payments, while a physical card is a tangible card you can use in stores, ATMs, and online.

How do I use the physical debit card for online payments?

Use your card details (number, expiry date, and CVV) at checkout just like any other debit card.

How can I apply for a physical TransferGo Visa debit card?

Simply sign in to your TransferGo app, confirm your identity, and follow the steps to request your physical debit card. It’s free until 2026, with fast delivery.

How long does it take to receive my physical debit card after applying?

Delivery typically takes up to 5 business days, depending on your location.

Do I need to activate my physical debit card once I receive it?

Yes, for security, you must connect your card through the TransferGo app before using it. Just follow the instructions that come with your new card.

Are there fees for ATM withdrawals with the physical debit card?

In the UK and EEA, you get up to £500 free across 3 withdrawals each month. For the rest of the world, you can withdraw up to £600 free every 30 days, after which a 3% fee applies.

Can I use my physical TransferGo Visa debit card abroad?

Yes, the card works globally for convenient spending and withdrawals.

What should I do if my physical debit card is lost or stolen?

Report the loss immediately through the TransferGo app or customer support to block the card and prevent unauthorised use—you can block it directly in the app.

How do I replace a lost or damaged physical debit card?

Request a replacement via the TransferGo app. A new card will be issued and sent to your registered address.

The card is issued by B4B Payments pursuant to license with Visa.